A Variable Capital Company (VCC) Fund is a type of investment vehicle introduced in Singapore in 2020, and have grown in popularity due to their flexibility, reduced regulatory requirements, and tax efficiencies. They provide a strong legal framework, long-term stability and easy access, making them an increasingly attractive option for fund managers (private equity, venture capital, real estate and hedge), institutional investors and family offices looking to build and safeguard their investments.

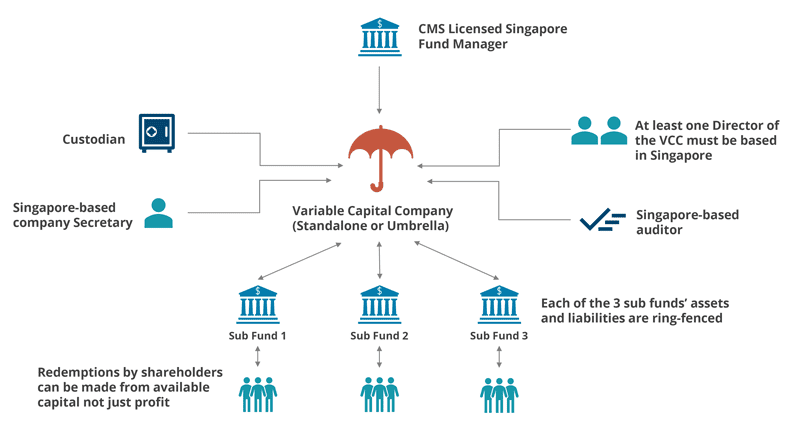

VCC Funds can only be managed by an asset manager, licensed and or registered by the Monetary Authority of Singapore (MAS). This ensures that there are strong credentials in place.

Key Features and Benefits of VCC Funds

- Flexibility:

- They can be set up as a standalone or umbrella structure, with sub-funds segregated by law.

- The sub-fund structure allows multiple investments, including real assets and real estate.

- Standalone fund or umbrella structures allow the fund to benefit from the segregation of assets and liabilities.

- They can be used to raise capital in a cost-efficient manner.

- Can be used to re-domicile foreign corporate entities.

- Provide access to Singapore’s bilateral investment protection treaties.

- They ensure there is privacy for investors as the Shareholders’ Register is not required to be made public.

-

Tax efficiency:

- VCC Funds offer tax efficiency, by allowing investors to access a wide range of tax treaties:

- Assets grow free of capital gains and income tax subject to qualifications.

- As a corporate entity, you may have access to Singapore’s Double Tax Treaties (of which there are over 80 in force).

- Distributions by fund and fund manager entities are not subject to dividend or other distribution withholding taxes in Singapore.

- VCC Funds offer tax efficiency, by allowing investors to access a wide range of tax treaties:

-

Ability to Customize Investment Strategies:

- VCC Funds can be tailored to specific investment strategies, allowing investors to customize their investment portfolios.

- Multiple sub-funds are allowed, with different strategies, objectives, investors and assets.

- These funds all operate independently of each other.

How can Amicorp help?

Our team comes with a wealth of experience in asset management, with in-depth market knowledge and access to a support network that spans the entire VCC Funds eco-system. If you would like to find out more about setting up a Singapore VCC Fund or want to talk to us about different fund structuring solutions, please contact the team here.