The Variable Capital Company (VCC) is a recent investment fund innovation, launched in January 2020 and aimed at increasing Singapore’s attractiveness as a competitive asset management hub in Asia. It is geared towards investors and fund managers looking for a jurisdiction which provides a strong legal environment, efficiency, long-term stability, easy access, cost benefits and tax efficiency.

WHAT IS A SINGAPORE VCC

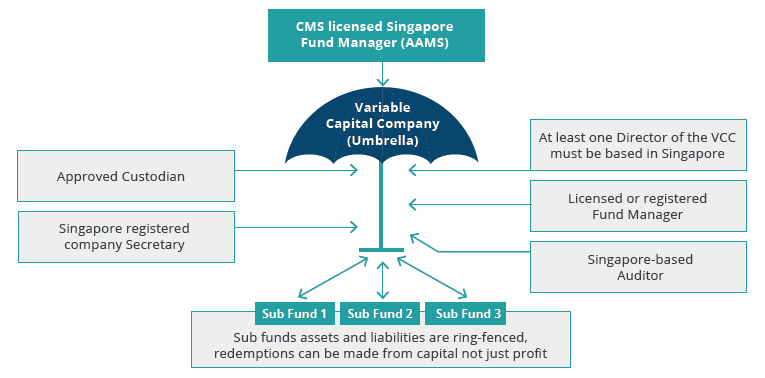

It is a new corporate vehicle designed to manage both traditional and alternative funds, including Private Equity. It can be setup as:

- A standalone or umbrella with sub-fund structure

- A structure for both open and closed ended investments

- A flexible vehicle that can hold single assets; or as

- An alternative to Partnerships and standard corporate vehicles

The VCC must be managed by an asset manager, licensed and supervised by MAS. This ensures strong credentials and gives the VCC a Singapore identity cementing its role in the region.

WHAT ARE THE BENEFITS

- Standalone or umbrella structure with sub-funds segregated by law and costs shared

- Sub-fund structure allows multiple investments including real assets and properties

- Assets grow free of capital gains and income tax subject to qualifications

- Privacy for investors as Shareholders Register is not required to be made public

- The potential to raise capital in a cost-efficient manner

- Provides improved operational and tax efficiency possibilities

- Can re-domicile foreign corporate entities (BVI and Cayman included)

AMICORP’S ASSET MANAGEMENT SERVICES

Amicorp Asset Management Singapore Pte Ltd holds a CMS license by the Monetary Authority of Singapore (MAS) and can manage VCC’s. As an independent licensed asset manager we provide a range of discretionary and advisory portfolio management services to assist accredited investors, including high net-worth individuals and families plan for their long-term business and investment needs. These services include but are not limited to:

- Discretionary portfolio management as well as advisory portfolio services to our target clientele (HNWIs/families with a need for Asset Management)

- Partnering with asset management companies in other jurisdictions, who would like their clients’ asset to be managed in Singapore under the VCC

- Alternative Asset Management - Singapore VCC

ANCILLARY SERVICES

At Amicorp we provide a comprehensive range of global management, corporate secretarial and entity administration services for multinationals, private equity, venture capital groups, financial institutions, family offices and high-net-worth individuals (HNWI). Supported by our global network of offices we ensure that all local administrative and regulatory obligations are managed promptly and on time. Our services can include:

- Corporate secretarial services

- Trust and foundation services

- Tax compliance and regulatory reporting (FATCA, CRS, ESR)

- Fund administration, set up & structuring services

- Investment portfolio administration

- Preparation of financial statements

ADVANTAGES OF WORKING WITH US

- An experienced local management team with global experience in Asset Management;

- In-depth knowledge

- Access to a network across the entire VCC eco-system

- A one-stop shop for all your financial service’s needs

- End-to-end support, leveraging the Group’s global network of businesses and offices

- Client-focused, holistic, long-term and collaborative approach to our clients’ needs

Our global network of offices and existing services complements our Asset Management solutions and allows us to provide the full suite of fiduciary services to clients, making us a ‘one-stop shop’ as a financial services provider.

If you would like to find out more about setting up a Singapore VCC Fund or want to talk to us about different fund structuring solutions, please contact the team here.

Related News

Case Study – FALGOM AG Deploys Quantitative Strategy at Scale via Amicorp’s AMC Structuring

Amicorp enables a Swiss quantitative investment firm to bring AI-powered trading strategies to market through a scalable, regulated investment structure.

Case Study – From Regional to Global: How Boutique Asset Managers Can Expand Without the Global Overhead

In today’s wealth management landscape, clients expect more than just returns they want global access, institutional credibility, and seamless service.

Case Study – Expanding Access to Fractional Art Investment through AMC Structuring and Global Distribution

Mintus is the first platform authorized by the Financial Conduct Authority (“FCA”) to fractionalize investment-grade contemporary art in the United Kingdom