Listed and unlisted corporate clients will often look to incentivize and retain their talent by offering benefits linked to the value of the business they contribute to.

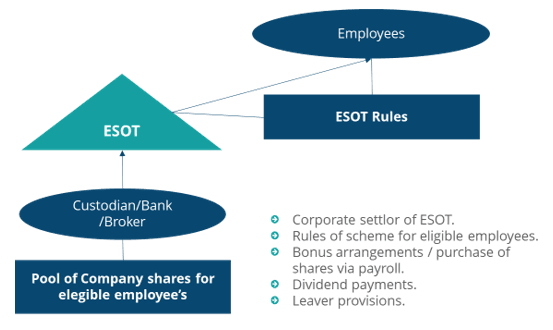

A Trust can be used to create such a platform. In such cases, the corporate client is the settlor, and the employees and possibly their immediate family are the beneficiaries. The corporate client can design a set of rules that govern the operation of the incentive plan. The Trustee holds assets and administers the plan independently for the benefit of the beneficiaries.

Employees Share Option Trust (ESOT) - example

Amicorp can be the Trustee and administrator of these vehicles in several of our Trust jurisdictions and offer other solutions in this area.

Rules should include:

Granting

Exercising

Time limits/lapsing

Leaver provisions

Voting/dividend other rights

Transferability

Amendment provisions

For listed clients, consideration will need to be given to the particular stock exchange rules and related disclosures. Further consideration and advice will be required about the taxation requirements applicable for both the employer and employee.

Please get in touch with any Amicorp Trust specialists if you have any queries about Amicorp Trust Services, or contact David Willis directly (d.willis@amicorp.com)

Barbados - barbados@amicorp.com

BVI - bvi@amicorp.com

Cayman - cayman@amicorp.com

India - amicorptrustees@amicorp.com

Malta - malta@amicorp.com

Mauritius - mauritius@amicorp.com

New Zealand - newzealand@amicorp.com

Singapore - singapore@amicorp.com

South Dakota - southdakota@amicorp.com

Switzerland - zurich@amicorp.com

Related News

U.S. Trusts and LLCs: A Strategic Solution for Global Families and Investors

When a Latin American family recently sold a commercial property in Florida, their advisors structured the deal through a South Dakota Trust holding a U.S. Limited Liability Company (“LLC”).

Amicorp Granted Financial Trustee License in Argentina to Support Investment Growth Opportunities

Amicorp Granted Financial Trustee License in Argentina to Support Investment Growth Opportunities

Singapore to South Dakota: Navigating the Spectrum of International Trusts

Trusts provide an efficient and flexible way of controlling how and when assets are distributed to selected beneficiaries, often forming a central part of any succession planning.