Many entrepreneurial families have diverse business interests and productive assets spread over one or more emerging markets countries. Those assets generally are difficult to leverage or finance and even more challenging to liquidize.

This may result in liquidity crunches for the business or the family and tensions or issues at a time of transition in control and ownership from one generation to the next, potentially frustrating optimal succession planning.

ADVANTAGES OF A FAMILY FUND

Create a Family Fund that holds all relevant business and productive assets of the family/patriarch under one consolidated Fund structure. This is done by transferring legal ownership of all operating entities as well as relevant partnerships, real estate, and other wealth into the Fund.

- Consolidation of individual valuations of underlying productive assets

- Control of related family assets under one management, even when allowing for succession planning and equity/debt financing

- Building a track record of the development of the value, demonstrating fluctuations in value as well as liquidity

- Possibility to attach an ISIN number, a first step towards visibility, securitization, and a future potential listing

- Audited consolidated value forms the basis for negotiations with banks and private equity of debt and equity financing

- An ISIN number allows for adding of the Fund as a security to a private banking portfolio

SUCCESSION PLANNING

The shares in a Family Fund can most easily be held directly in the name of its Ultimate Beneficial Owners. Alternatively, the Fund can be securitized (listed), and the shares can be owned indirectly via the listing agent, or the shares can be held in a Trust or a Private Foundation for the benefit of future beneficiaries. Such a structure allows for control over the Fund to be kept centrally, while the economic rights can accrue over time and be traded between a defined circle of eligible investors (heirs, ultimate beneficial owners, trusted employees, business partners, etc.). The settlor or the Founder can maintain certain rights for himself as retained Founders’ rights or as a Protector.

Additionally, the workings of the commercial side of family relationships can be governed by a tailor-made Family Charter, which can be developed over time and describe in detail the rights and obligations of those who are involved in the family business and those who are not. This, in turn, can be a first step towards a (shared) Family Office.

COMPLIANCE & REPORTING

To establish a Fund, regular KYC documentation needs to be submitted on each of the participants, and the origin of wealth and source of funds needs to be demonstrated. Each participation needs to be well defined, accurately accounted for, and properly evaluated.

Family Funds are to be established in jurisdictions with strong regulatory regimes to safeguard the business, participations, and other family assets in a sustainable Fund structure. This can be in a neutral tax regime to avoid additional costs at the Fund level. Certain Funds can benefit from tax treaties to facilitate cross-border investments without triggering double taxation.

Family Funds can be tailored to the needs of each family and other investors. They are fully compliant with the recent global transparency developments of FATCA and Common Reporting Standard (CRS) and compliant with the latest BEPS developments of the OECD as rolled out in local tax regimes and implemented in international tax treaties. As a result, the various types of Family Funds may well be accepted by the various investors and authorities in which the various family members and other investors reside.

FEES

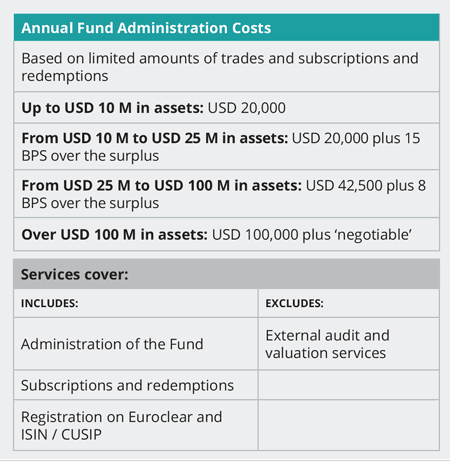

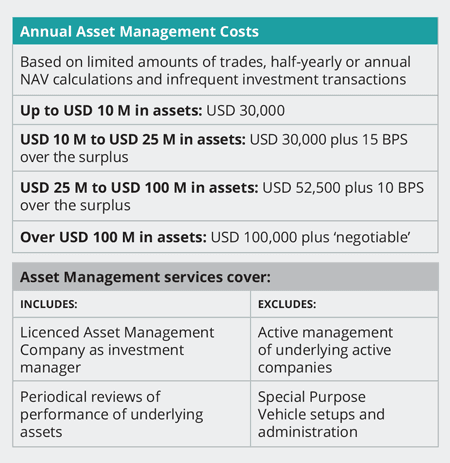

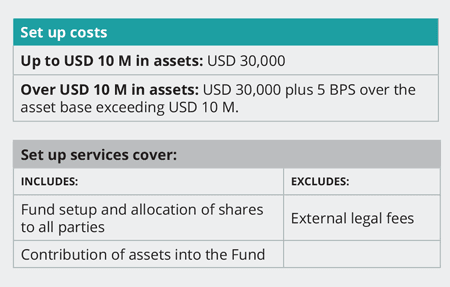

The establishment of a Family Fund in a tax-exempt jurisdiction or a sub-fund in a VCC:

For more information:

Debashish Dasgupta, Chief Sales Officer (CSO) - d.dasgupta@amicorp.com Derk Scheltema, Chief Commercial Officer (CCO) - d.scheltema@amicorp.com

Related News

Amicorp Secures Spanish License to Support AIF Investments Across Europe

Amicorp Group has been granted an Alternative Investment Fund Manager (“AIFM”) license by the Spanish regulator that allows us to manage and structure Alternative Investment Funds (“AIFs”) across Europe. It means Amicorp can provide a regulated, flexible, and cost-efficient platform to a diverse range of private asset investment and marketing opportunities.

Case Study – FALGOM AG Deploys Quantitative Strategy at Scale via Amicorp’s AMC Structuring

Amicorp enables a Swiss quantitative investment firm to bring AI-powered trading strategies to market through a scalable, regulated investment structure.

Case Study – From Regional to Global: How Boutique Asset Managers Can Expand Without the Global Overhead

In today’s wealth management landscape, clients expect more than just returns they want global access, institutional credibility, and seamless service.