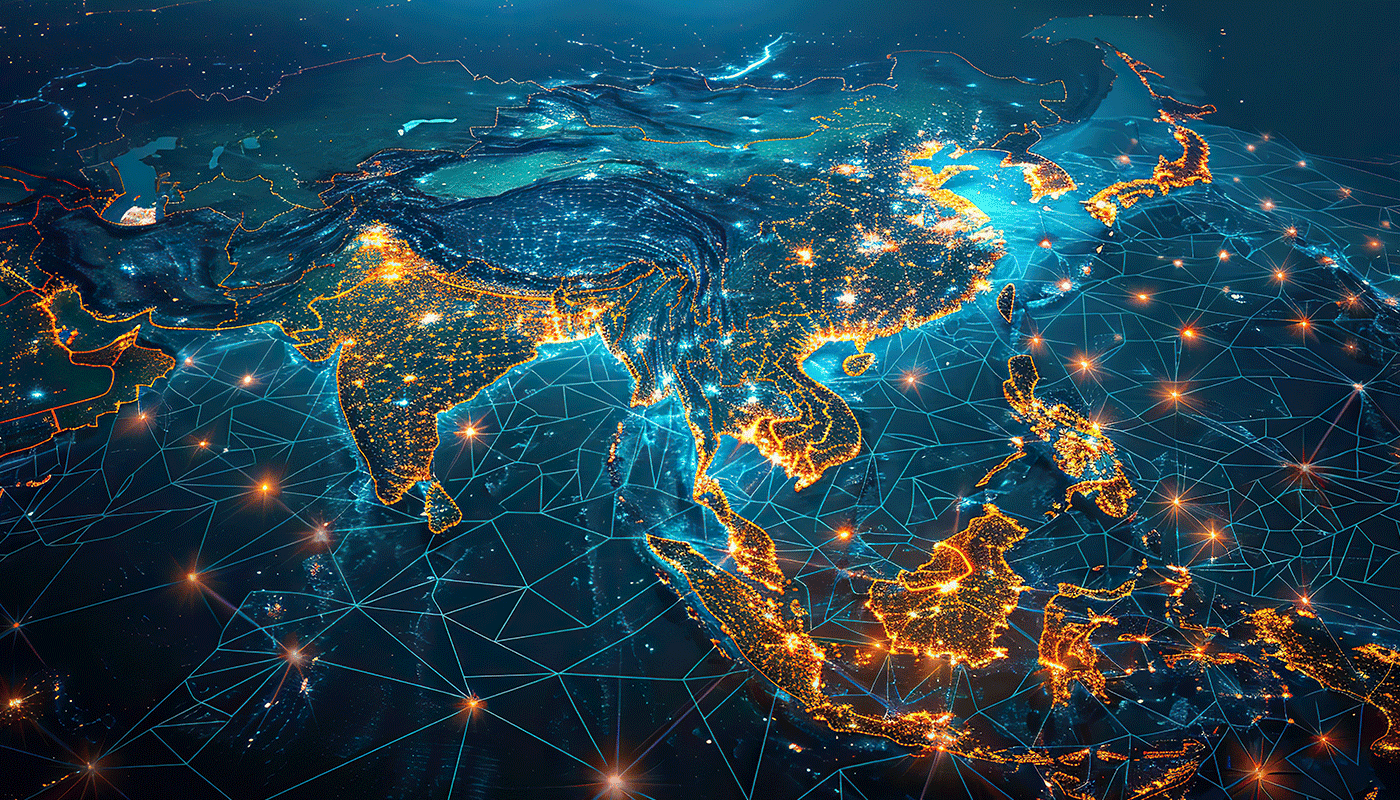

The economies of Southeast Asia have been among the fastest growing in the world over the last few decades, fueled in part by their proximity to the powerhouse of China. But the region’s growth is about much more than its giant neighbor. Southeast Asia has a powerful story to tell about its domestic development, its role in wider global trade and the opportunity of presents for foreign investment.

The prevailing narrative in global economics is that the era of globalization is waning, but in Southeast Asia the reality is quite the opposite. International trade is growing, domestic economies are expanding and opportunities for investment are legion.

Overall economic growth in the 10-strong Association of Southeast Asian Nations (“ASEAN”) is forecast by the International Monetary Fund (“IMF”) to be 4.5% in 2024, markedly stronger than the global growth forecast of 2.9%. Naturally, many ambitious businesses are looking to the region for opportunities to expand or set up operations.

The jewels of the SE Asian economy

Singapore has long been recognized as a hub for trade and finance across the region, but increasingly it is also seen as a steppingstone to the wider opportunities across Southeast Asia and to five key economies in particular – Indonesia, Malaysia, the Philippines, Thailand and Vietnam.

These jewels in Southeast Asia are themselves vital trade hubs within the region and trade and economic cooperation between them and other countries is growing rapidly. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (“CPTPP”) is the most obvious signs of these developments but there are many others, including for example the EU-Vietnam Free Trade Agreement.

Each of these five economies has its unique strengths – and unique challenges – but a common factor across these jewels is their young populations. Many developed economies face tight labor markets, skills shortages and an ageing population. In stark contrast these economies have a median age between five and 10 years lower than in the US or Europe.

Download our market insights report here.

At the same time increasing investment in education is fueling their capacity in skilled manufacturing and technology. Exports of electronics computers and computer components from Vietnam for example grew at a bracing 28% in the first half of 2024.

Growing middle-class offers attractive consumer markets

With an increasingly skilled workforce and robust economic growth these economies also represent a growing consumer market – the populations of these five key economies are increasingly not just makers, but also shoppers.

It is estimated that 65% of the ASEAN region’s population will be middle class by 2030. According to the World Bank, Indonesia alone will be home to150 million middle class consumers by 2030.

What is more, these populations are digitizing at speed with their ecommerce economies forecast to expand dramatically. The World Economic Forum estimates that the number of people online in Singapore, Indonesia, the Philippines, Malaysia and Vietnam has doubled in the last eight years. In Indonesia, Vietnam and Thailand, the penetration of mobile payments is higher than in either the US or Europe.

Plugging into local expertise

The opportunities in large parts of Southeast Asia are legion, but companies looking to expand into these fast-developing economies face some challenges. Regulations around company ownership, licensing, taxation, accountancy and employment are different and often tangled in each of these economies, and in some cases even vary within a single nation.

These hurdles, however, are far from insuperable. Successful expansion into these economies can be achieved with expert advice from professionals with deep knowledge of both the regulatory frameworks and the cultural challenges that can arise.

With professionals on the ground in the region, Amicorp can help ambitious companies get set up and operate across international borders, guiding them through the processes and regulations required to grasp the significant growth opportunities available in Southeast Asia.

To learn more about the growth opportunities in Southeast Asia’s jewel economies download our market insights report here.

Related News

Amicorp Opens Office in Vietnam to Support Southeast Asia Expansion

Amicorp Group is proud to announce the opening of its newest office in Ho Chi Minh City, Vietnam. This strategic development forms part of our broader commitment to expanding integrated support across key Southeast Asian markets, providing clients with on-the-ground expertise in one of the region’s fastest-growing economies.

Event – India-Saudi Arabia Trade Relations & Market Entry Strategies

We are pleased to invite you to an exclusive, invite-only roadshow designed for Indian businesses and investors seeking to explore opportunities in the Kingdom of Saudi Arabia (“KSA”).

Amicorp expands services with DIFC corporate service provider license

Amicorp Group is delighted to announce it has been granted a Corporate Service Provider License by the Dubai International Financial Center ("DIFC"), strengthening its commitment to supporting asset managers, family offices, banks, and corporations looking to set up and operate in the Middle East and North Africa's ("MENA") leading financial hub.