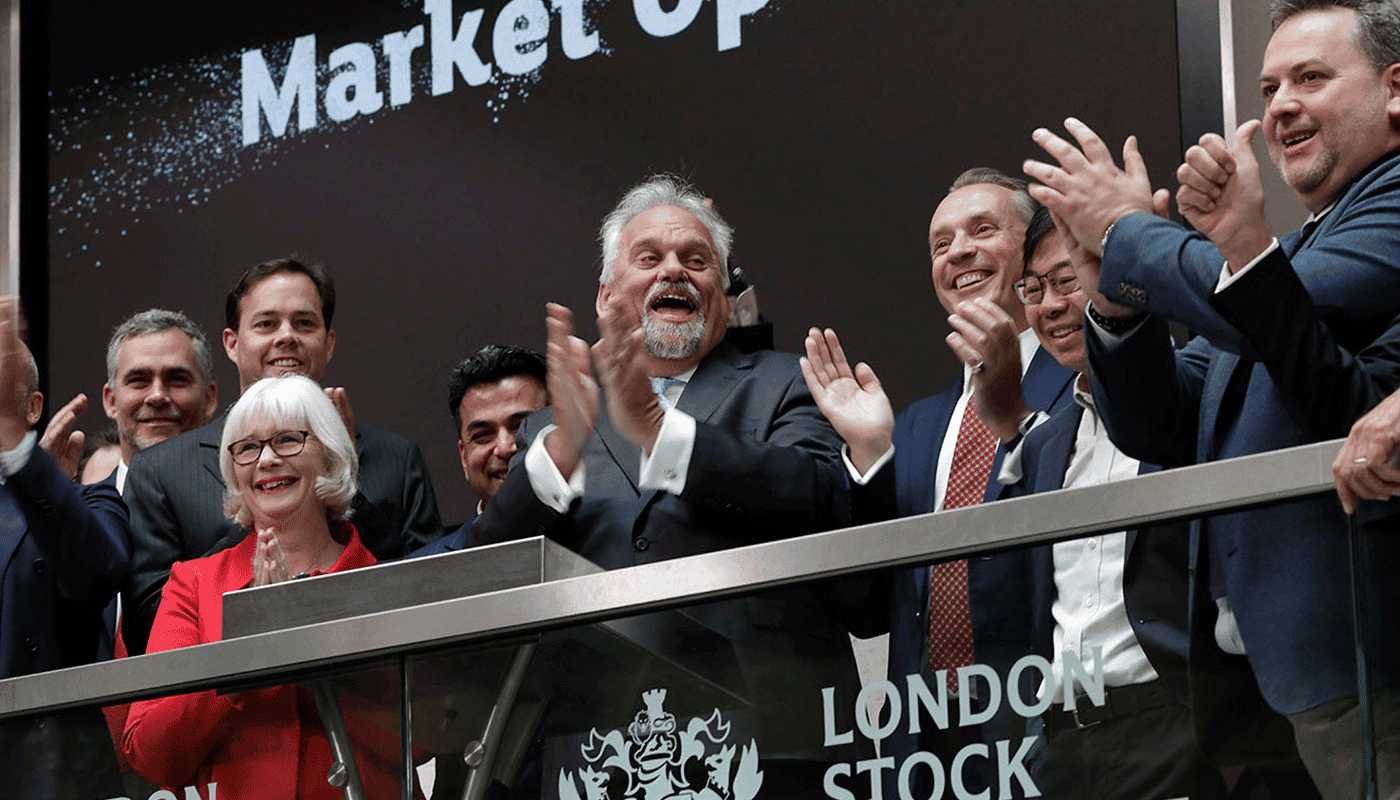

Amicorp Group is delighted to announce its fund services business, Amicorp FS (UK) Plc ('AMIF'), successfully listed on the London Stock Exchange's Main Market on 8 June 2023.

The listing of AMIF marks a significant step forward for this business to accelerate its growth ambitions, both organically and through acquisitions, at a time when demand for fund services continues to rise as more investors switch to using funds to provide a more efficient, flexible, and cost-effective investment vehicle.

In addition, ongoing changes in tax legislation and financial reporting requirements across multiple jurisdictions are further increasing that demand as many family offices now look to use funds to organize better estate planning, family succession and as a means of bundling several families into joint investments.

Fund vehicles like Venture Capital Companies ('VCCs') offer asset managers, family offices, and investors significant benefits by providing a flexible platform to create different investment structures and open the door to a wide range of different tax treaties. AMIF is one of the few providers to have VCC licenses in both Singapore and Mauritius.

Toine Knipping, CEO of Amicorp Group, said: "With less trust in banks, we are seeing billions of dollars being moved into funds, particularly private equity and venture capital funds. This presents a significant opportunity for AMIF to service that exodus given our already well-established network, and to now build on that further off the back of the listing to provide our clients with even more opportunities."

The capital raised through the listing of AMIF will be used to expand its global sales team, to bring new innovative technology solutions to market, particularly artificial intelligence capabilities to bring improved efficiencies, and to acquire additional fund administration licenses, adding to the seven licenses AMIF already has in place.

"AMIF's plans include obtaining a fund administrator license in Ireland and a custodian license in Luxembourg, spreading its geographical reach to cover more of the world's financial centers and diversifying its income streams," added Toine Knipping.

"Earlier this year we started a fund administration department in Brazil, which is already getting great interest, and we are also exploring the Gulf Region as well as East Asia for further expansion opportunities; underpinning AMIF's focus on emerging markets and rising financial centers and instruments."

The majority of the capital raised via the listing will be used for acquisitions and consolidation of what is widely recognized as a fragmented marketplace, which will boost AMIF's footprint internationally.

To find out more about the listing, please visit the AMIF investors page here. If anyone is interested in finding out more about cooperation or investment opportunities in the business, please contact the team here.

Related News

Optimizing Capital Growth with a Smart Fund Foundation

Cross-border fund management continues to gain traction with investment professionals, family offices, and institutional investors looking for compliant, tax-efficient ways to grow and protect wealth. But structuring a fund for success, especially across borders, requires more than just regulatory alignment.

Amicorp Secures Spanish License to Support AIF Investments Across Europe

Amicorp Group has been granted an Alternative Investment Fund Manager (“AIFM”) license by the Spanish regulator that allows us to manage and structure Alternative Investment Funds (“AIFs”) across Europe. It means Amicorp can provide a regulated, flexible, and cost-efficient platform to a diverse range of private asset investment and marketing opportunities.

Case Study – FALGOM AG Deploys Quantitative Strategy at Scale via Amicorp’s AMC Structuring

Amicorp enables a Swiss quantitative investment firm to bring AI-powered trading strategies to market through a scalable, regulated investment structure.