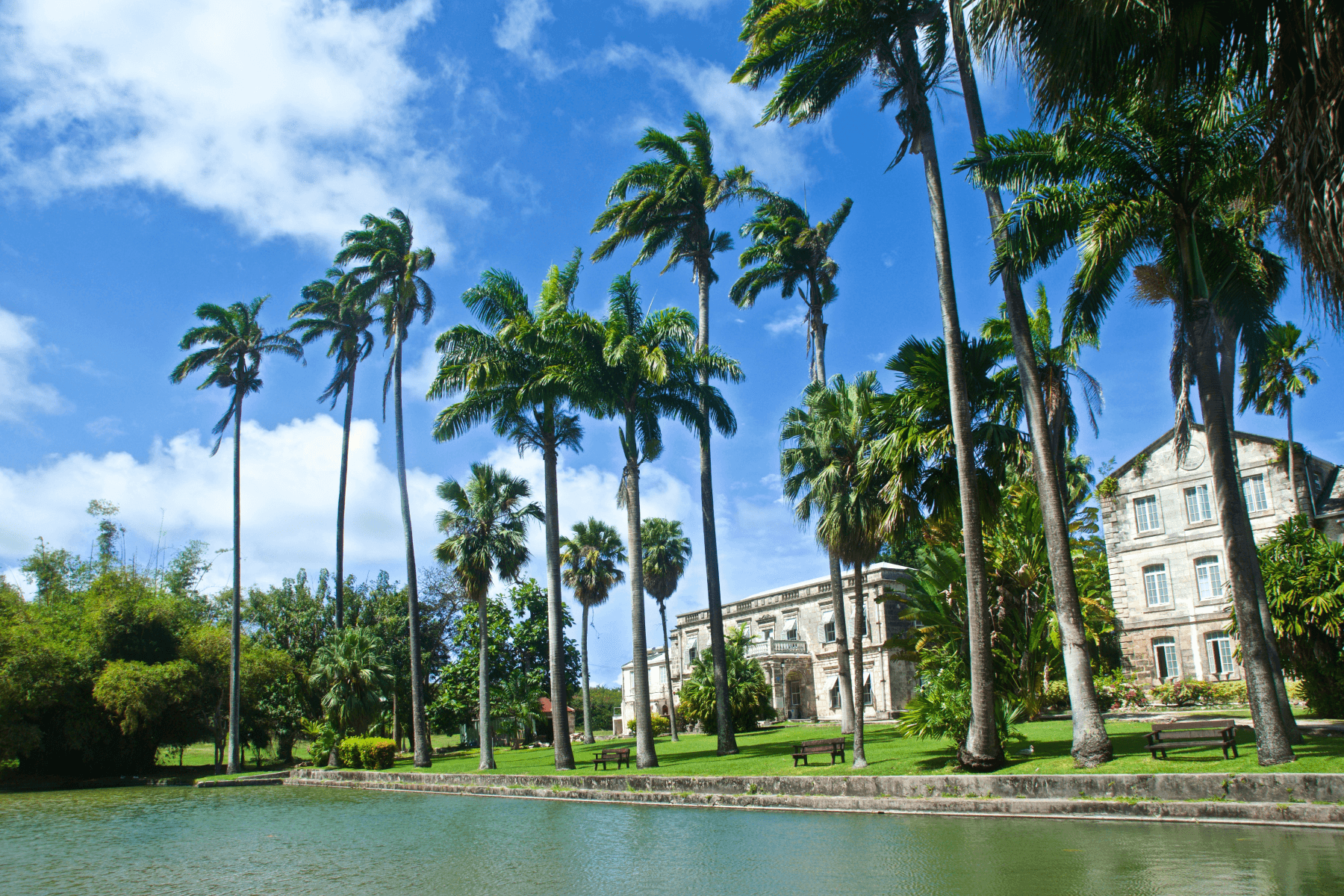

Amicorp (Barbados) Ltd.

Carleton Court High Street Bridgetown, St. Michael Barbados BB11128

A power player in international cross-border structuring, Barbados is a Caribbean jurisdiction on the OECD white list that offers highly attractive international tax planning benefits without the stigma of being blacklisted.

The international business company (IBC) is Barbados's most popular entity and is widely used as an investment and trading vehicle. With an exceptionally low corporate income tax rate of between 1.0 to 2.5%, depending on the IBC’s income level, this entity offers investors a host of advantages. Among these are quick incorporation, transfer tax exemptions, no withholding tax on distributions, business flexibility, no minimum capital requirement, and many more.

Other Barbadian entities and services that offer significant benefits include:

- Barbados segregated cell companies (SCCs);

- International trusts and licensed trustee trusts;

- Exempt insurance companies (captive insurance);

- Barbados societies or international societies with restricted liability (SRLs / ISRLs);

- Barbados domestic companies;

- Registration of an external company;

- Registration of a franchise;

- Company re-domiciliation (continuance);

- Mutual funds

Barbados offers clients access to a large network of 24 double income taxation treaties with the following countries:

Austria, Botswana, Canada, CARICOM, Cuba, Finland, Luxembourg, Malta, Mauritius, Mexico, Norway, Panama, People’s Republic of China, Seychelles, Spain, Sweden, Switzerland, the Netherlands, the United Kingdom, the United States, and Venezuela. Treaties with Portugal and Ghana have been signed and are awaiting ratification.

Amicorp Barbados also provides various trust and financial services through Amicorp Bank and Trust Limited, incorporated in Barbados as an international bank and regulated by the Central Bank of Barbados. (Further information available at www.amicorpbank.com)

Languages spoken: English and Spanish

Our team