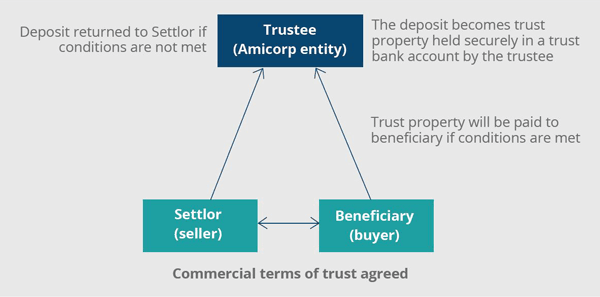

Parties can use an escrow arrangement as a way of mitigating counterparty risk on commercial transactions. The item (s) in escrow are safeguarded by a trusted neutral 3rd party. Amicorp (UK) Limited is set up as a Trust Corporation and can act as the neutral party by using a trust arrangement.

ESCROW TRUST ARRANGEMENT

The trust arrangement is documented using the Amicorp standard trust deed. The settlor and the beneficiary agree to the commercial aspects. Amicorp, as the trusted, neutral 3rd party, receives and releases the trust property when the predefined conditions or events are met. Trust property can be defined in the trust deed as cash, securities, and other assets such as USB data sticks.

TYPICAL USES OF ESCROW IN COMMERCIAL TRANSACTIONS

- Aviation and shipping purchases

- Capital markets litigation disputes

- Mergers and acquisitions

- Real estate finance

- Regulatory requirements

- Supply chain cross-border trades

- High yield bond issuances

CASH ESCROW TRUST ARRANGEMENT

Amicorp (UK) Limited, acting as a trustee under a trust deed, can be chosen as the neutral 3rd party. Triggers that control money and notices are then negotiated between the parties and entered into the Amicorp trust deed.

Once the triggers have been met, money is released, and any notices are given. The trust arrangement is terminated, and any accounts connected with the trust arrangement closed.

If the seller, the buyer, or both do not have offices in England, Amicorp can also act as its process agent under the English Law trust deed.

HOW CAN AMICORP GROUP ASSIST YOU

Amicorp can also offer escrow services from our LatAm offices, including Uruguay, Mexico, and Argentina, or via Amicorp Bank & Trust (ABT) based in Barbados.

ADDITIONAL JURISDICTIONS THAT OFFER THE ESCROW TRUST AGREEMENT SERVICES

- Mauritius

- Singapore

ADVANTAGES OF WORKING WITH US

- Ability to work to the clients’ timelines

- Proactive and collaborative team

- Multiple counterparties, releases, and notices accommodated

- Trust property ringfenced from Amicorp (UK) Limited’s assets

- Process agent services offered to those without an office in England or Wales

For more information, please contact us here

Related News

Dubai’s ICC – A Multi-strategy Funds Platform With Legal Segregation and Speed

Naman Goel, Executive Director, Amicorp Capital (DIFC) Limited, shares his views on why the Incorporate Cell Company structure is a game-changer for investors looking for operational efficiency, structural flexibility and/or a robust way of segregating assets and liabilities.

Case Study – Sponsor Uses VCC To Create Shareholder Structure For Shipping Private Equity Fund

VCC funds provide flexible structures to suit different investment strategies and needs, including as part of a shareholder structure for a private equity fund. Read on to find out how a sponsor in the shipping business did just that.

Structuring for Impact: Fund Platforms vs. Securitization for German Investors

At Amicorp, we consistently see one question rise to the top in investor conversations: What’s the right vehicle for my investment strategy? That’s why we recently hosted an expert session at our Frankfurt office, “Comparing Fund Structures and Securitization for German Investors in a Changing Landscape”, bringing together legal, tax, and capital markets specialists for a highly focused discussion.