33 years of building lasting relationships

— Amicorp provides specialized corporate management, financial markets, and fund administration services that improve efficiencies, simplify operations, ensure compliance and open up new opportunities.

— We believe that mutual trust and an in-depth understanding of our clients' requirements are vital for successfully managing their business and family processes. Through close collaboration, we gain insights into their needs, and offer reliable, long-term interactions that ensure their peace of mind.

Our approach

Over the past three decades, we have focused on developing innovative and bespoke solutions that help businesses and entrepreneurs, asset managers, institutional investors, high-net-worth individuals ("HNWIs") and family offices succeed in a dynamic macro environment, building lasting and trusted relationships along the way.

Whether you're a high-growth technology business planning your cross-border expansion, an asset manager searching for shared investment vehicles to give you easy access to a new market opportunity, or a business owner looking for a trusted partner who can help you and your entities stay compliant with changing global and regional regulations, our team is here to help.

Financial markets

Our team supports cross-border transactions and manages and administers a wide range of deal structures, from plug-and-play securitizations and Special Purpose Vehicles ("SPVs") to listings, bonds and syndicated loans.

Management

We offer a range of corporate management, fiduciary, and compliance services that add an extra layer of support and expertise to help you maintain, protect, improve and grow your assets and investments.

Fund

Years of client partnerships

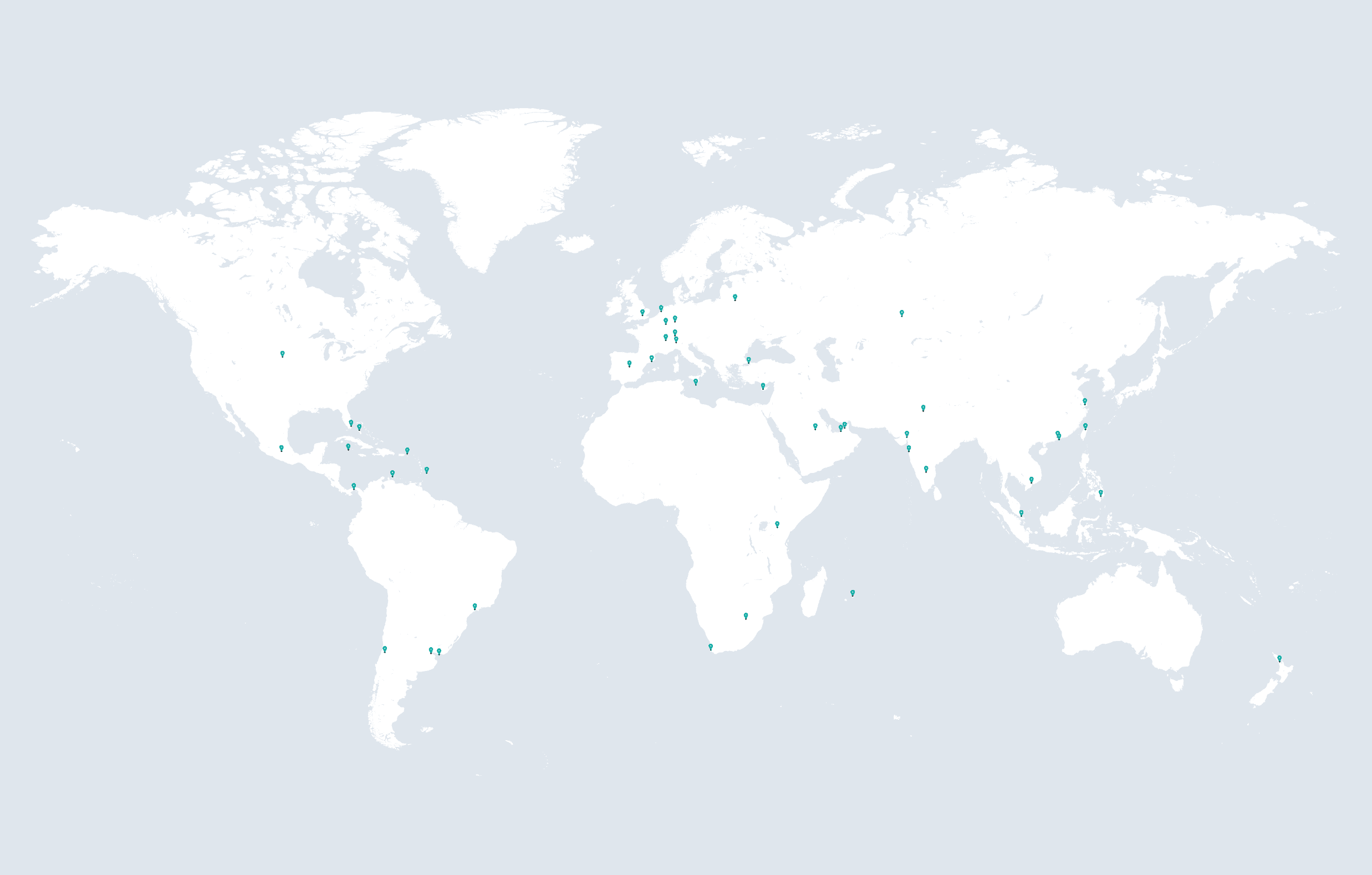

Offices worldwide

Regulated licenses

Wholly-owned ESG projects

We're building a better future for people and the planet.

We are committed to being a responsible corporate citizen.

Through our internal policies and the Amicorp Community Foundation ("ACF"), we strive to empower local communities and create lasting structural change that ensures a better future for people and the planet.

Our projects include the Amisewaka – Desa Les Community Center in Bali, our Tuma Mi Man daycare center in Curaçao, our Trees for Schools program in South Africa, and our AmiForest reforestation project to offset our carbon emissions from travel.

With a deep commitment to sustainability, equity, and systemic change, we believe our greatest strength lies in collaboration and listening deeply to the needs of both people and planet. Together, we will cultivate bold ideas, elevate local voices, and steward resources with care and clarity, grounded in humility, driven by impact, and guided by a vision of a more just and regenerative future.

Growing together, beyond borders.

Our News

Structure with Confidence: Corporate Governance and Regulatory Compliance for Global Investment Architecture

Global investors are not constrained by opportunity. They are constrained by infrastructure. Capital today is highly mobile in theory, yet surprisingly static in practice. Investors want exposure across India, Africa, the Middle East, Europe, the Americas, and Asia, but the pathways that allow capital to move cleanly across those regions remain fragmented.

Amicorp expands its regulatory footprint in the UAE

Amicorp Fund Services (DIFC) Limited has been granted a Category 4 license by the Dubai Financial Services Authority (DFSA) to provide Fund Administration services within the Dubai International Financial Centre (DIFC).

Dubai’s ICC – A Multi-strategy Funds Platform With Legal Segregation and Speed

Naman Goel, Executive Director, Amicorp Capital (DIFC) Limited, shares his views on why the Incorporate Cell Company structure is a game-changer for investors looking for operational efficiency, structural flexibility and/or a robust way of segregating assets and liabilities.